how to pay indiana state taxes quarterly

QuickBooks Self-Employed calculates federal estimated quarterly taxes. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable.

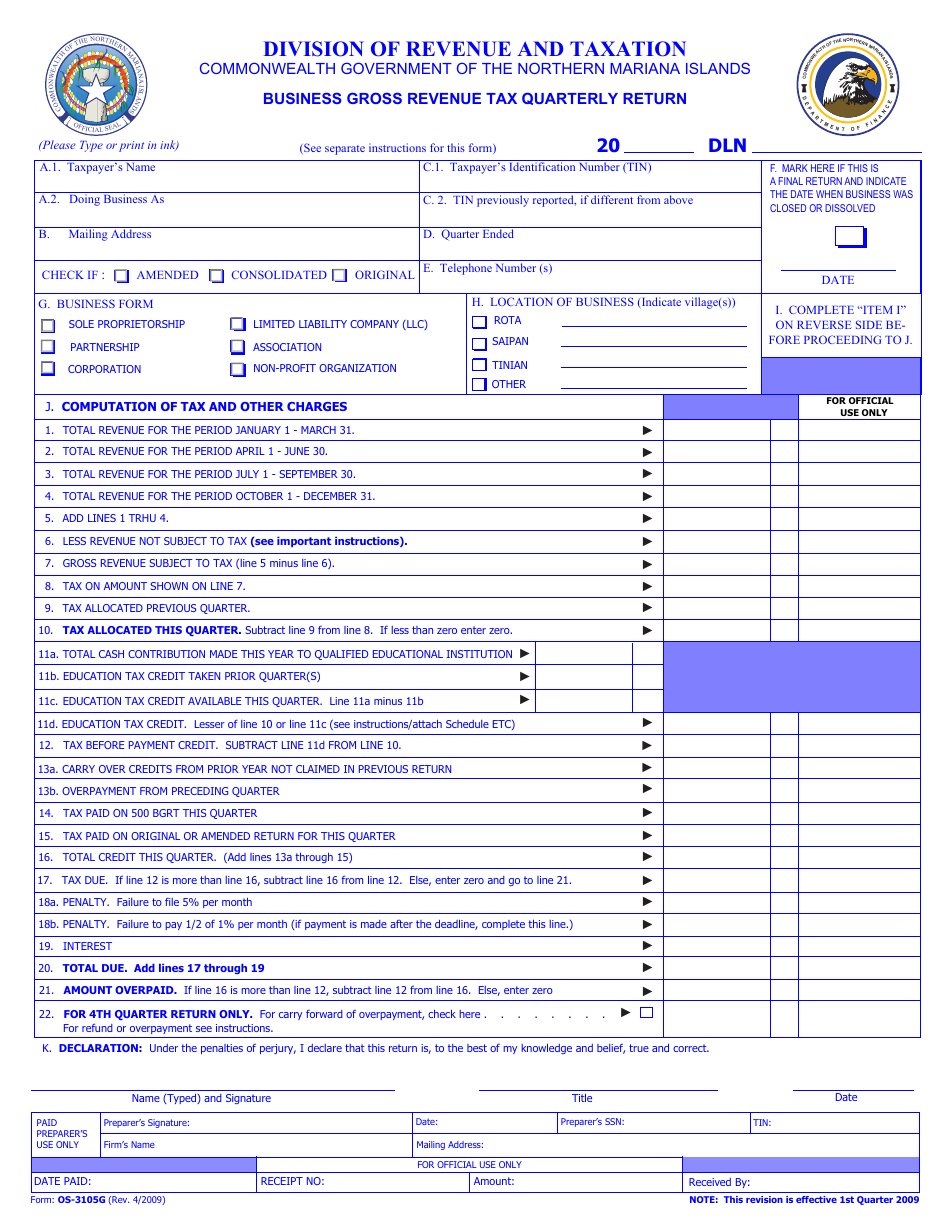

Form Os 3105g Download Fillable Pdf Or Fill Online Business Gross Revenue Tax Quarterly Return Northern Mariana Islands Templateroller

Please use one of the following options to pay your Consumer Use Tax.

. Pay personal income tax owed with your return. Pay income tax through Online Services regardless of how you file your return. You can also pay using paper forms supplied by the IRS.

Paying the IRS Federal The easiest way to make a federal quarterly tax payment is to use IRS Direct Pay. Depending on your income youâll probably need to deposit 15 to 50 of your pay in the highest tax brackets. Payment of estimated taxes is due in installments.

Visit IRSgovpayments to view all the. Some states have great websites but if youre not so lucky you can always just mail a check. Send an estimated quarterly tax payment to the IRS.

Enter this amount on line 4 Estimated Tax Installment Payment at the top of the form. However if your net earnings equate to less than 5000 you may be able to file a Schedule C-EZ instead. Choose to pay directly from your bank account or by credit card.

Take someone who pays. The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax account s in one convenient location 247. Due dates are mid-April June September and the January following the last month of the calendar year.

This includes making payments setting up payment plans viewing refund amounts and secure. The failure-to-pay penalty is less punitive than the one for failing to file. Box 595 Indianapolis IN 46206-0595.

Employees fill out Indiana Form WH-4 Employees Withholding Exemption and County Status Certificate to be used when calculating. EFT allows our business customers to quickly and securely pay their taxes. 15 2023 is a Sunday and Monday Jan.

We last updated the Estimated Tax Payment Voucher in January 2022 so this is the latest. Keep also in mind that apart from federal taxes depending on which state or city you live in you might need to pay quarterly taxes to your state too. This means you may need to make two estimated tax payments each quarter.

That penalty starts at 05 of your total tax owed and increases every. Visit IRSgovpayments to view all the options. View the amount you owe your payment plan details payment history and any scheduled or pending payments.

For more information call 317 232-5500. Every jurisdiction has its own tax rates and different due dates so make sure to double-check with the pertinent tax agency in your state. Pay by mail by sending a check payable to.

Line I This is your estimated tax installment payment. Pay online using MasterCard Visa or Discover at the Indiana state government ePay website see Resources. Service provider fees may apply.

Some states also require estimated quarterly taxes. How to Pay Quarterly Taxes So if you discover youre required to pay quarterly taxes you must first use Schedule C of Form 1040 to determine how much you owe. Once youve calculated your quarterly payments You can submit them online through the Electronic Federal Tax Payment System.

Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable. How to pay quarterly taxes. If you wait until the end of the year to file taxes youll have to pay a penalty.

Most states offer two options for making the payment. You can pay your quarterly taxes several ways. Sign In to Pay and See Your Payment History.

When you file your annual tax return youll pay the balance of taxes that werent covered by your quarterly payments. INtax only remains available to file and pay the following tax obligations until July 8 2022. Make a same day payment from your bank account for your balance payment plan estimated tax or other types of payments.

Go to Your Account. An online portal and mailing a check. Since youll owe more than 1000 you will have to make quarterly payments.

If you apply for an extension of time to file and owe tax you need to make your extension payment by the due date. Enclose a copy of your bill with the check or write your Social Security tax liability number or warrant number on the check. 16 is Martin Luther King Jr.

You may send estimated tax payments with Form 1040-ES by mail or you can pay online by phone or from your mobile device using the IRS2Go app. While some tax obligations must be paid with EFT several thousand businesses use the program for its speed and convenience. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov.

You can pay or schedule a payment for any day up to and including the due date. Pay personal income tax. By adding the self-employment tax and the income tax you will get the total amount for the income taxes that you need to pay that year.

For additional information refer to Publication 505 Tax Withholding and Estimated Tax. If youre self-employed you need to pay federal estimated quarterly taxes for the income you make. KY Department of Revenue.

One to the IRS and one to your state. Indiana requires employers to withhold income taxes from employee paychecks in addition to employer paid unemployment taxesFind Indianas tax rates here. To learn more about the EFT program please download and read the EFT Information Guide.

Day a federal holiday in the United States the deadline to pay estimated taxes on. Mail a check or money order made payable to KY State Treasurer to. Tax Liabilities and Case Payments.

Whats the penalty for not paying quarterly. The amount you should deposit depends on your federal and state income tax brackets and the number of your tax deductions. This step gives them some assurance that theyâll have enough money to pay their taxes.

You can go to the IRS payment page and set up online payments for your taxes using a bank account or a debit card. In the example above youll get 8950. If the due date falls on a national or state holiday Saturday or Sunday payment postmarked by the day following that holiday or Sunday is considered on time.

Now that youve figured out your quarterly tax payment all you have to do is pay Uncle Sam. Estimated payments may also be made online through Indianas INTIME website. The IRS charges 05 of the unpaid taxes for each month with a cap of 25 of the unpaid taxes.

Indiana Department of Revenue PO. Lines J K and L If you are paying only the amount of estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. Indiana State Payroll Taxes What are my state payroll tax obligations.

How To Pay Quarterly Income Tax 14 Steps With Pictures

How To Pay Quarterly Income Tax 14 Steps With Pictures

Payroll Tax Submission Rejection

Pennsylvania Sales Tax Small Business Guide Truic

How To Pay Quarterly Income Tax 14 Steps With Pictures

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Dor Keep An Eye Out For Estimated Tax Payments

Indiana In Ifta State Tax Ifta Quarterly Fuel Tax Ifta Online

What Is Local Income Tax Types States With Local Income Tax More

How To Pay Quarterly Income Tax 14 Steps With Pictures

Quarterly Tax Calculator Calculate Estimated Taxes

How To Pay Quarterly Income Tax 14 Steps With Pictures

Tax Withholding For Pensions And Social Security Sensible Money